Welcome back to Why Join.

Before we dive in—here are a few newsletters that are actually worth your inbox:

Alternative Investing Report, A Smart Bear: Longform, TLDR Newsletter, AI Tool Report.

No fluff, just quality reads. Give them a look.

Sponsored by

Has Cold Outreach Felt Colder Lately?

Let Redrob’s AI Open Doors for You

🔍 Pull Verified Contact Info

Access emails, phone numbers, and socials—200M+ profiles at your fingertips.

⚡ Book Meetings With Ease

Train your own AI assistant and put outreach on autopilot.

📢 Make Every Message Matter

Break through the noise with prospects, talent, and investors.

This Week in Startups

🇺🇸 Saronic Technologies

Funding – Series C, $600M; Valuation – $4B (4x in 7 months, Unicorn: July 2024); Investors – Elad Gil (lead), General Catalyst (new), a16z, Caffeinated Capital, 8VC

What it does: Autonomous Surface Vessels (ASVs) for modern naval warfare.

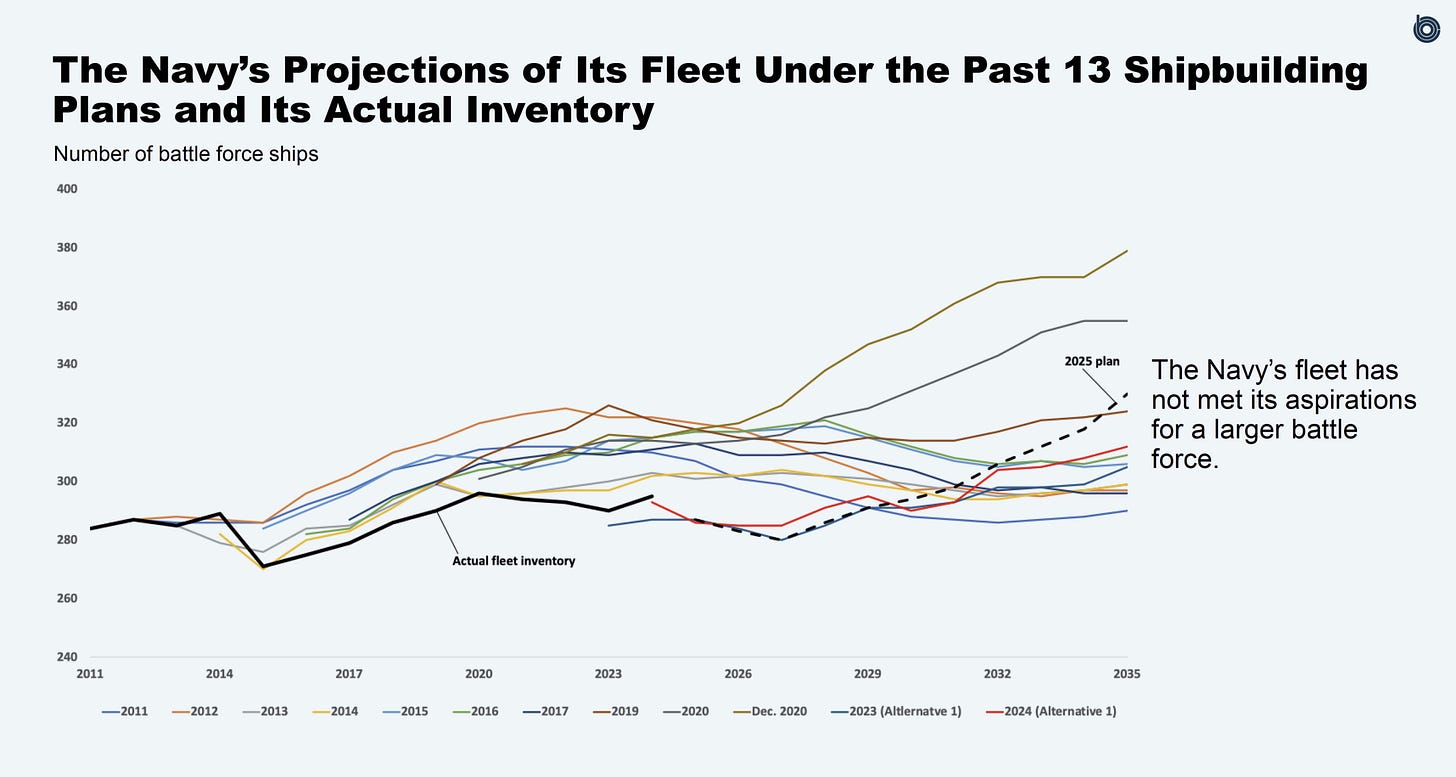

Why it’s a fave: Traditional fleets are vulnerable to swarms of fast, AI-driven threats. Saronic is redefining maritime operations with ASVs designed for speed, autonomy, and scalability. Their vessels—Spyglass, Cutlass, and Corsair—seamlessly integrate with existing fleets, enabling AI-driven autonomy, ISR, and modular payloads for dynamic combat scenarios.

But Saronic isn’t just building vessels—it’s reengineering shipbuilding1 itself. With a software-first approach, they enable rapid deployment, continuous upgrades, and scalable production. The future of maritime dominance won’t be won with sheer tonnage—it will be won with intelligence, speed, and autonomy.

Job openings: Electrical Engineer Intern, Electrical Engineer Intern (Integration, Communication and Perception), Test Engineer Intern, Market Intelligence Analyst, Front End Software Engineer, Software Engineer, Generalist, Customer Service Representative, Contracts Associate, Product Designer, Senior Analyst, Program Finance (Austin, TX)

🇺🇸 Baseten

Funding – Series C, $75M (Total: $135M); Investors – IVP, Spark (co-leads), Greylock, Conviction, South Park Commons, 01 Advisors, Lachy Groom

What it does: AI inference infrastructure for production-scale deployment

Why it’s a fave: AI models are useless if they can’t run efficiently in production. Scaling inference is complex—managing GPUs, reducing latency, and ensuring uptime require deep infrastructure expertise.

Baseten optimizes model deployment across clouds, slashes cold starts, and integrates with TensorRT-LLM for peak efficiency. With 99.999% uptime and built-in observability, it makes AI inference fast, reliable, and effortless.

Job openings: Software Engineer - Infrastructure, AI Support Engineer, Sales Development Representative, Digital and Content Lead, Account Executive (SF/NY/Remote)

🇺🇸 Sanas AI

Funding – Series B, $65M (Total: $100M+); Investors – Quadrille Capital (lead), Insight Partners, Quiet Capital, DN Capital, Teleperformance (new)

What it does: AI-powered real-time accent translation

Why it’s a fave: Accent bias is real, and Sanas is tackling it head-on. Instead of forcing call center agents through frustrating "accent neutralization" training, Sanas uses AI to adjust accents in real time while preserving the speaker’s natural tone and emotion.

With over 50 million speech samples powering its models, Sanas is already serving 50+ customers across healthcare, logistics, and manufacturing—pulling in $21M in ARR.

Job openings: Senior Applied Machine Learning Scientist (Bangalore/Palo Alto, CA), QA Engineer - Audio Driver (Bangalore)

Top News

Amazon shuts down Chime: Amazon’s video conferencing app, Chime, is shutting down for good. If you didn’t know it existed, well… you’re not alone. Launched in 2017 as a competitor to Zoom and Google Meet, Chime never really caught on outside of Amazon. Now, the company is pulling the plug. New signups ended this week, and full shutdown is set for February 20, 2026. What’s next? Amazon is officially recommending alternatives like AWS Wickr, Slack, and—ironically—Zoom.

HP buys Humane’s AI tech: HP is buying Humane’s software, IP, and most of its team—including ex-Apple founders Imran Chaudhri and Bethany Bongiorno—for $116M. But the AI Pin? It’s dead. Launched in 2024, the $699 device promised to replace smartphones but flopped due to glitches, bad reviews, and even fire risks. Humane had raised $230M and once sought a $1B buyout—now, HP is picking up the pieces. The team will lead HP’s new AI division, integrating on-device AI into PCs, printers, and more. The deal closes this month.

Musk wants $44B for X: Elon Musk is trying to raise fresh funding for X at a $44 billion valuation—the same price he paid in 2022. That’s a bold move considering X’s ad struggles and past debt concerns. But investor sentiment may be shifting. Last week, Morgan Stanley sold $3B of X’s debt at full value, signaling renewed confidence. Is X really worth $44B? That’s now up to investors to decide.

Nikola files for bankruptcy: Nikola, once hailed as the Tesla of trucking, has officially filed for bankruptcy. The EV startup, which hit a $30 billion valuation in 2020 before selling a single truck, burned through cash and never scaled production. Founder Trevor Milton’s fraud conviction didn’t help. Investors bailed, shares crashed, and now Nikola is left with just $47M in cash against up to $10B in liabilities. It joins a growing EV graveyard—Lordstown, Arrival, Canoo—while Rivian and Lucid fight to stay afloat. The electric revolution? Still happening. Just not for Nikola.

Niantic nears $3.5B sale: Niantic, the company behind Pokémon Go, is in talks to sell its gaming unit to Saudi-owned Scopely for around $3.5 billion. The deal would include Pokémon Go and other mobile titles, though it’s not finalized yet. Once a global sensation, Pokémon Go remains the most profitable AR game ever, but Niantic has struggled to replicate that success. Scopely, acquired for $4.9B in 2023, is looking to expand its mobile gaming empire—this acquisition would be a major step.

Rivian’s cost cuts pay off: Rivian has been tightening its belt—cutting 10% of its workforce, simplifying its EVs, and reworking 600 parts to lower costs. The result? A $170M gross profit in Q4 2024, with $60M coming from software and services. But 2025 won’t be smooth sailing. Rivian warns that policy shifts under the Trump administration—like potential cuts to EV tax credits and tariffs—could hit its bottom line hard. CFO Claire McDonough estimates the impact could reach “hundreds of millions.” Meanwhile, software is becoming a bigger part of Rivian’s business. A Volkswagen joint venture and new AI-powered customer service tools are helping drive efficiency—and revenue.

Figure AI chases $39.5B valuation: The humanoid robotics race is heating up. Figure AI is reportedly raising $1.5B at a staggering $39.5B valuation—up from just $2.6B last year. Investors? Align Ventures, Parkway, plus existing backers like OpenAI, Microsoft, and Jeff Bezos. Why the hype? Figure says its robots have cracked more advanced reasoning, fast-tracking their path to real-world deployment. CEO Brett Adcock claims they could ship 100,000 units in four years. Meanwhile, Tesla’s Optimus and Meta’s robotics push are keeping the pressure on. But with BMW already a customer, Figure is betting big on a future where humanoid robots aren’t just sci-fi.

Who's Hiring

Fusion Fund - Investment Analyst - Palo Alto, CA

500 Global - Legal Operations Associate - Dubai; Analyst - Seoul

Cowboy Ventures - Senior Associate - Palo Alto, CA

Geek Ventures - VC Analyst - EU (CEE region preferably)

PhonePe - Intern - CA - Bangalore

Motional - Machine Learning Internship - Singapore

Infinite Machine - Content Creator - New York

SellScale - Full Stack Engineer (Co-Op / Internship), Full Stack AI Engineer (Founding) - San Francisco, CA

Lighthouse - Design Engineer, Product Designer, Legal Operations Associate, Immigration Specialist, Business Development Associate - San Francisco, CA

Didero AI - Product Designer - NYC

Augury - Sales Development Representative - US, Remote

Mintlify - Technical Writer, Product Engineer, Design Engineer, AI Engineer - San Francisco, CA

Popcorn - Flutter Developer, Founding Product Designer - Europe (CET +/- 2 hours), Remote

Hyperline - Sales BDR, Partnerships Manager, Brand Designer - Paris

That's all for today.

See you on Tuesday—

New here? Subscribe for free.

Get in touch about sponsorships: chief@whyjoin.xyz