Something’s Shifting

AI agents in security, debt, outbound, and maps. One $2B stealth raise. And the quiet rebirth of the browser.

Hey there—

Welcome to another edition of Why Join.

Before we jump in: been seeing a quiet shift in browsers lately. Perplexity, Arc, Opera, even OpenAI, all working on agentic browsers that try to do more than just load pages. Stuff like summarizing docs, booking things, or organizing tabs for you. Some early versions are interesting, others feel half-baked. Most require full access to your accounts, and in Comet’s case, $200/month.

Not saying Chrome’s done. But it’s the first serious attempt at rethinking the browser since Chrome ate the market.

Now, onto this week’s edition.

Sponsored by

Stop scheduling status update “check-ins”

56% of workers say scheduling a meeting is the only way to get information.

With Jira, use AI to automatically add work from Slack, create subtasks, or attach relevant resources.

So instead of scheduling a meeting, check the status in Jira. Easy.

P.S. Want to sponsor this newsletter? Simply reply to this email or book one here.

This Week in Startups

🇺🇸 Cogent Security

Funding – Seed, $11M; Investors - Greylock (lead), Lockstep

Cogent builds autonomous security agents that manage the full vulnerability management lifecycle: detecting exposures, assessing risk, and directly remediating issues across infrastructure.

The volume of published vulnerabilities is exploding (45,000+ CVEs in 2024 alone), and AI-powered exploits are closing the window from discovery to breach. Traditional VM (vulnerability management) tools can’t keep up—they alert, but don’t act. Most security teams are buried in alerts without enough context, and remediation still depends on coordination across engineering, infra, and compliance.

Cogent’s system runs continuously, identifying real risks, prioritizing based on context (not just CVSS scores), and autonomously fixing issues with limited human oversight. Early deployments show a >2x speed improvement in closing vulnerabilities and a 50% reduction in workload.

Hiring: Fullstack Engineer, AI/ML Engineer, Backend Engineer - San Francisco / New York

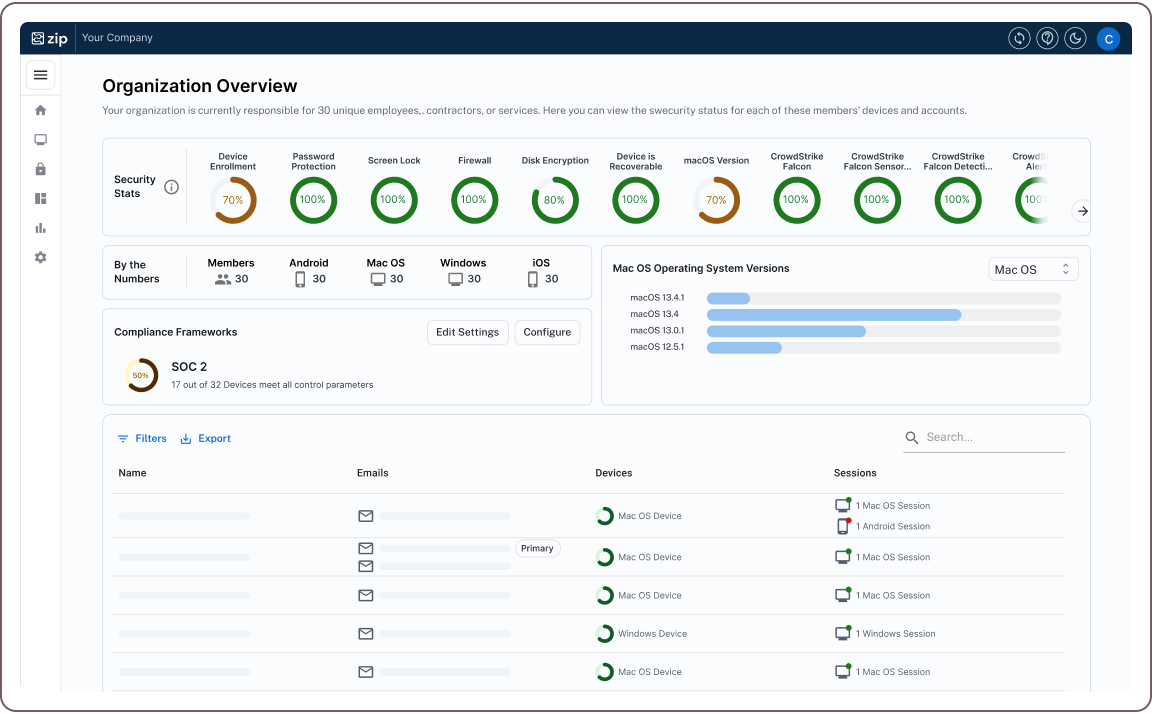

🇺🇸 Zip Security

Funding – Series A, $13.5M; Investors – Ballistic Ventures (lead), General Catalyst, Human Capital, Mantis VC, Box Group

Zip is a cybersecurity platform purpose-built for mid-sized businesses and lean IT teams. Think: endpoint protection, identity management, secure browsing, and compliance workflows—packaged in a single interface that doesn’t require a CISO to operate.

Most mid-market companies can’t afford dedicated security teams. Many don’t even have a full-time security hire. What they do have is a patchwork of tools, half-configured by consultants, rarely monitored. Zip replaces that with an all-in-one system that automates best practices across device security, access control, threat detection, and compliance (SOC 2, HIPAA, ISO 27001).

Hiring: Chief of Staff - NYC; Digital Demand Generation Manager, Product Marketing Manager - Remote

🇪🇸 Murphy

Funding – Pre-seed / Seed, $15M; Investors – Northzone (lead), ElevenLabs, Lakestar, Seedcamp, Enzo Ventures

Each year, more than $700 billion in consumer debt defaults across the US and Europe. A large share of it goes unrecovered. Servicing non-performing loans is labor-intensive and expensive, especially for lower-value portfolios that can’t justify the cost of manual outreach.

Murphy gives financial institutions and collection agencies a new model. Its AI-native voice agents and messaging flows handle negotiation, engagement, and resolution at scale. The agents are multilingual and support two-way communication across SMS, email, WhatsApp, and phone. They operate autonomously to manage conversations in compliance with regulatory frameworks and are designed to reflect the emotional and legal nuances of debt collection, including built-in safeguards for vulnerable customers. The system improves with every interaction and works across use cases that were previously too costly to service.

Hiring: Prompting Engineer, Head Of GTM, Senior AI Engineer - Barcelona

🇺🇸 Unify

Funding – Series B, $40M; Investors – Battery Ventures (lead), OpenAI Startup Fund, Thrive Capital, Emergence Capital, Abstract Ventures, The Cannon Project, Capital49

The outbound playbook of the last decade—more reps, more emails, more tools—is breaking. Legacy platforms like Outreach and ZoomInfo helped scale volume, but channel fatigue set in. Reply rates dropped. Productivity sank. And high-growth teams started asking a harder question: what actually works now?

Outbound is shifting from volume to precision. Success no longer comes from sending more messages, but from sending the right message, to the right person, at the right time. Using real data and signals, not guesswork.

But most teams aren’t set up for this shift. Workflows are stitched together from enrichment tools, ABM platforms, intent data, and messaging software. Signals are fragmented. Reps waste time managing tools instead of closing pipeline.

Unify is rebuilding outbound from first principles. Its platform combines real-time data, AI-powered workflows, and execution in one system. Teams can identify warm prospects, personalize outreach across channels, and run campaigns that adapt to buyer behavior, all with minimal overhead.

It’s not about replacing reps. It’s about giving lean teams the infrastructure to move faster, with sharper targeting and better timing.

Hiring: Software Engineering Intern, Product Manager, Growth, New Business Representative, Senior Software Engineer (DevOps) - SF / NYC

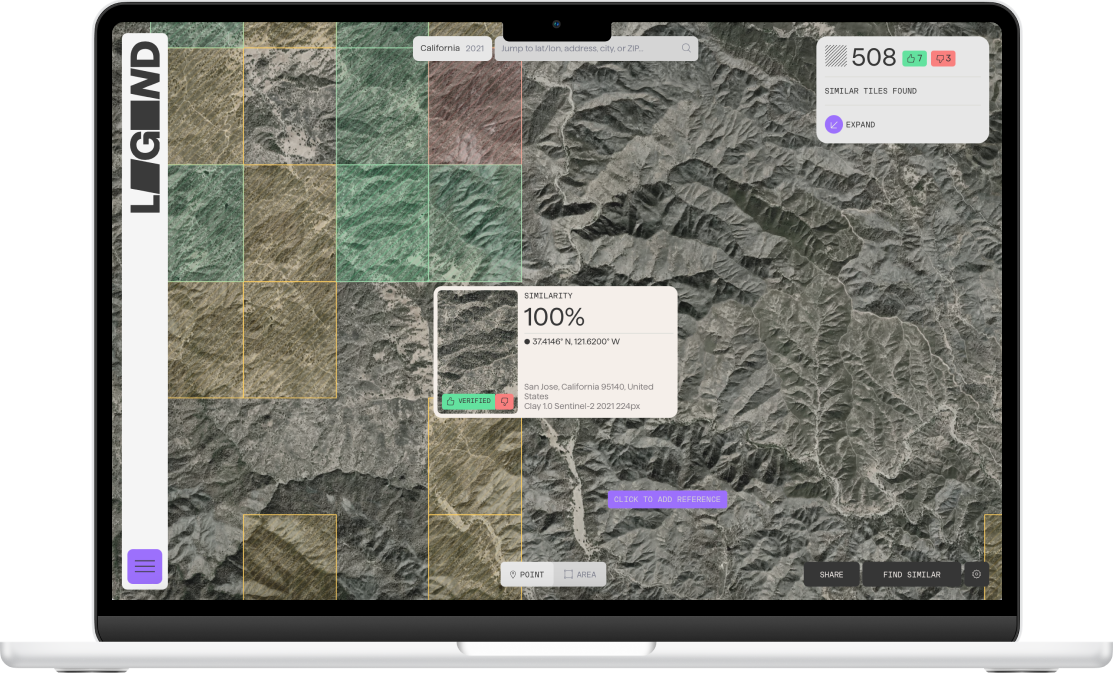

🇺🇸 LGND AI

Funding - Seed, $9M; Investors - Javelin Venture Partners (lead), AENU, Clocktower Ventures, MCJ, Overture, Ridgeline, Space Capital, Coalition Operators, and angels from Ramp, Keyhole, and Salesforce

LGND makes geospatial data machine-readable.

Instead of relying on raw satellite imagery or clunky shapefiles, LGND builds vector embeddings—compact representations that let developers and analysts run spatial queries without training custom models or manually labeling maps.

Earth observation data is abundant. Satellites collect over 100 terabytes every day. But most of it goes unused because geospatial tooling is fragmented, expensive, or designed for governments and defense contractors. LGND abstracts away that complexity. Its embeddings compress high-dimensional spatial data into reusable layers that can power applications across climate, logistics, and AI.

Embeddings are the key unlock. Just as word embeddings transformed how machines process language, LGND’s geographic embeddings let models interpret physical space, turning pixels into structured inputs. That means faster experimentation, fewer bespoke pipelines, and a broader range of users who can query the Earth like an API.

Use cases: Wildfire detection and response; Urban planning and zoning; Insurance and climate risk modeling; Precision agriculture; ESG reporting and audit trails; AI travel, navigation, and real estate search

Hiring: Full Stack Engineer - New York / San Francisco / Copenhagen / Philadelphia

Invest in recession-resilient Mobile Home Parks with Vintage Capital (Sponsored)

Invest in recession-resilient Mobile Home Parks with Vintage Capital. Invest direct or in a fund of 20+ underlying assets. 1031s are also available. Access stable, income-generating properties with consistent demand and low tenant turnover.

Now is the time to act: Current market conditions are creating opportunities to acquire properties at attractive valuations.

Our fund targets a 15%–17% IRR and makes monthly distributions, which provide a steady income stream alongside strong upside potential and tax-efficient benefits.

Why Mobile Home Parks?

Recession-Resilient: Affordable housing demand drives stable returns in any economy

High Tenant Retention: The average MHP tenant stays 10–12 years (compared to 2–3 in Multifamily)

Proven Expertise: $100MM+ track record in mobile home park investments

Tax-Smart Investing: Bonus depreciation offers tax advantages

Top News

Scale AI cuts 14% of staff after Meta deal: Scale AI is laying off 200 employees (14%) and ending contracts with 500 global contractors, mostly from its data-labeling division, per Bloomberg. The move follows Meta’s $14.3B acquisition of Scale AI’s CEO last month. Interim CEO Jason Droege cited overexpansion and customer losses post-deal. Scale will now pivot toward enterprise and government sales, mirroring other reverse acqui-hire pivots like Inflection.

Labubu craze sends Pop Mart profit up 350%+: Pop Mart expects H1 profit to jump 350%+ as revenue more than triples, driven by viral demand for Labubu dolls. US sales rose 5,000% YoY, with help from Kim Kardashian and Lisa (Blackpink). Pop Mart, now valued at $40B, gets nearly 40% of revenue from outside China. Some dolls resell for $100s, with one human-sized Labubu fetching $150K. Surge has also triggered a counterfeit boom—China seized 46K fakes in June.

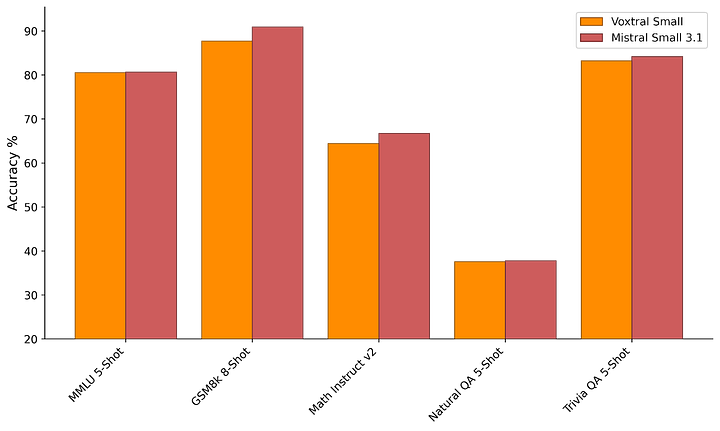

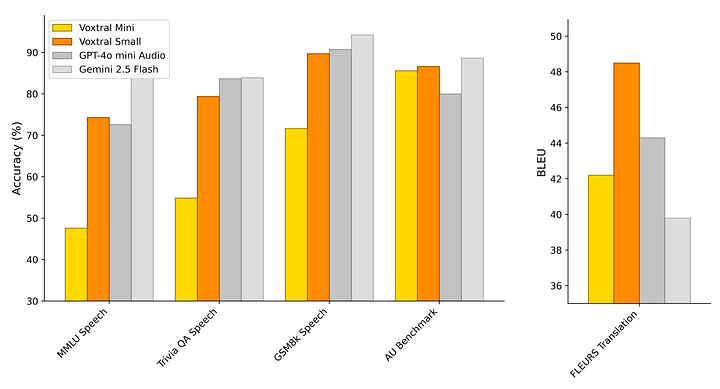

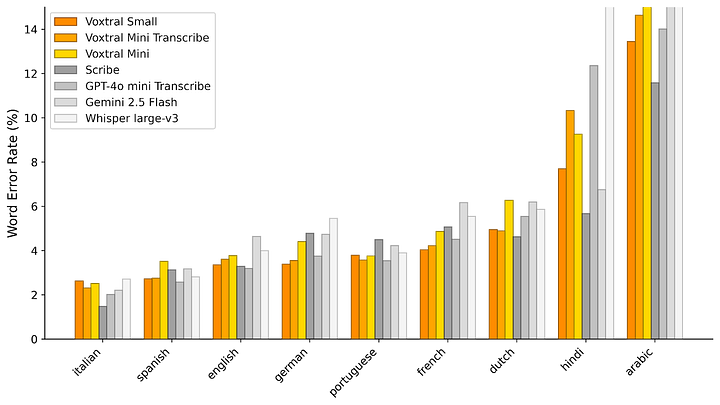

Mistral launches Voxtral to rival Whisper and ElevenLabs: Mistral has launched Voxtral, an open-source speech understanding model family aimed at transcription, semantic audio analysis, and voice-driven AI agents. Available in 24B and 3B Mini variants under Apache 2.0, Voxtral beats Whisper V3, GPT-4o Mini, and Gemini 2.5 Flash on key multilingual benchmarks. Features include 32K token context, QA + summarization from voice, and $0.001/min transcription API. Mistral also teased enterprise tools like speaker ID, emotion detection, and on-prem deployment.

Cognition acquires Windsurf after Google poaches execs: Cognition, maker of AI coding agent Devin, has acquired Windsurf, days after Google hired away the startup’s CEO, CTO, and research leads in a $2.4B reverse-acquihire. Cognition is picking up Windsurf’s AI IDE, its IP, and the ~250-person team left behind—plus $82M ARR and 350+ enterprise customers. Windsurf will regain full access to Claude, after Anthropic cut ties in June over OpenAI acquisition rumors. Notably, 100% of Windsurf staff will receive equity—a contrast to Google’s deal.

Uber partners with Baidu for robotaxis in Asia, Middle East: Uber and Baidu have inked a multiyear deal to deploy Apollo Go robotaxis across Asia and the Middle East starting later this year. Baidu’s autonomous fleet, already surpassing 11M rides, edging out Waymo, will be integrated into the Uber app, adding to Uber’s global shift toward being a platform, not a builder, of self-driving tech. Uber already partners with players like WeRide, Pony AI, and Waymo, with AV rides now live in Phoenix, Austin, Atlanta, and Abu Dhabi.

DoD awards $200M AI contracts to Anthropic, OpenAI, Google, and xAI: The U.S. Department of Defense is granting up to $200M in AI development contracts to Anthropic, OpenAI, Google, and xAI to build AI agents for national security missions. The move expands the DoD’s AI adoption push under its Chief Digital and AI Office. xAI also launched Grok for Government, now available via the federal GSA schedule. OpenAI, already under a $200M DoD contract since 2024, recently rolled out OpenAI for Government for public-sector deployments.

Thinking Machines Lab raises $2B at $12B valuation: Mira Murati’s stealth AI startup Thinking Machines Lab just closed a $2B seed round led by a16z, with backing from Nvidia, AMD, Cisco, Jane Street, Accel, and others. The round values the company at $12B, despite no product yet. Murati says a “significant open-source offering” is coming in the next few months, aimed at researchers and startups building custom models. Ex-OpenAI leads like Schulman, Zoph, and Metz have already joined.

US eases chip curbs, Nvidia and AMD resume AI chip sales to China: Nvidia and AMD have secured US approval to resume sales of H20 and MI308 AI chips to China, unlocking billions in potential revenue. The move comes after diplomatic trade talks and intense lobbying from Nvidia CEO Jensen Huang. The H20 approval restores access for Chinese firms like Alibaba and DeepSeek. Nvidia’s China data center revenue had been at risk—up to $15B in FY2026, per Bloomberg.

Prime Day drives $24B in U.S. e-commerce; GenAI traffic surges 3,300%: Amazon Prime Day (July 8–11) generated $24.1B in U.S. online sales—30.3% YoY growth, equivalent to two Black Fridays. Adobe Analytics also reported a 3,300% YoY spike in GenAI-driven retail traffic, though channels like paid search (28.5% share) and influencers (19.9%) still dominate conversions. Influencers outperformed social media 10x in effectiveness. Top product categories: appliances (+112%), office supplies (+105%), and electronics (+95%). Amazon didn’t break out numbers, but called it its biggest event ever.

Open Roles

Balderton Capital: Analyst - London

Baseten: Software Engineer (Core Product), Machine Learning Engineer (Fine Tuning), Fullstack Engineer (Core Product), Product Manager, Digital and Content Lead, Head of Revenue Operations - San Francisco / New York

Base Power: Software Engineering Intern, Growth Intern, Fullstack Engineer, Growth Marketing, Sales Development Representative - Austin, TX

Arcadia: Data Analyst (Tariff Ops), Software Engineer II - Salesforce, Software Engineer II - Python (RUDE squad), Data Engineer III - Chennai

Layer: Founding GTM, Fullstack Engineer, Backend Engineer - San Francisco

Campfire: Fullstack Engineer, Product Marketer, Growth Marketer, Founding Designer, Head of Sales, Head of Partnerships - San Francisco

Catena Labs: Full Stack Engineer, AI Engineer, Head of Legal & Compliance - Remote (US)

Wispr Flow: ML Scientist, Product Designer - San Francisco

Baton: Onboarding Specialist, Business Development Representative, Business Development Associate - NYC

Bland: Full Stack Engineer, Machine Learning Engineer, Growth Coordinator - San Francisco

That’s all for now. If you liked what you read, consider adding us to your address book or just hit reply—it helps with deliverability. If not, you can unsubscribe below.

See you Sunday,

Chief